The following guest contribution is provided by Hardik Sanghavi, who graduated from DePaul University in 2016 with a major in finance and minor in accounting. During his time at DePaul, Hardik interned with ESPN Chicago and Priority Sports & Entertainment. He now works as a Commercial Underwriter in the Insurance Industry and writes for Overthecap.com. You can follow him on twitter at @hardiks94.

During the last few months, NFL Agents visited college campuses across the country to recruit draft- eligible players to their client roster. With the majority of incoming rookies now committed to an agency, I wanted to take a look at where the top agencies have found the most recruiting success based on their active client roster.

The table below illustrate the colleges that have generated the most clients for each of the top agencies. One trend to point out relates to the location of an agency and the success of recruiting in that area. For example, Athletes First is based out of Laguna Hills and 12.4% of the agencies client roster played college football at USC. Other agencies that seem to have leveraged their local presence in recruiting is Rosenhaus Sports Representation and Select Sports Group. RSR is based in Miami and 18.1% of their active clients are Miami Hurricanes while 34% played college football in the state of Florida. Select Sports Group is headquartered in Houston and approx. 34% of their client roster played football in the state of Texas.

In other notable news, Young Money APAA acquired Cleveland based PlayersRep Sports, bringing their NFL client count to 46. The acquisition adds to the growing trend of mergers/acquisitions activity in recent years, in a list which includes CAA and Five Star Athlete Management, Paramount Sports & Entertainment and 320 Sports, and Rep 1 Sports and The Novo Agency. A reason for the increased M&A activity could be linked to the rising costs in representing players and the pressure on lowering commissions. With margins decreasing for agencies, I would expect more mergers in the future and for larger agencies to gain more market share and drive out smaller firms.

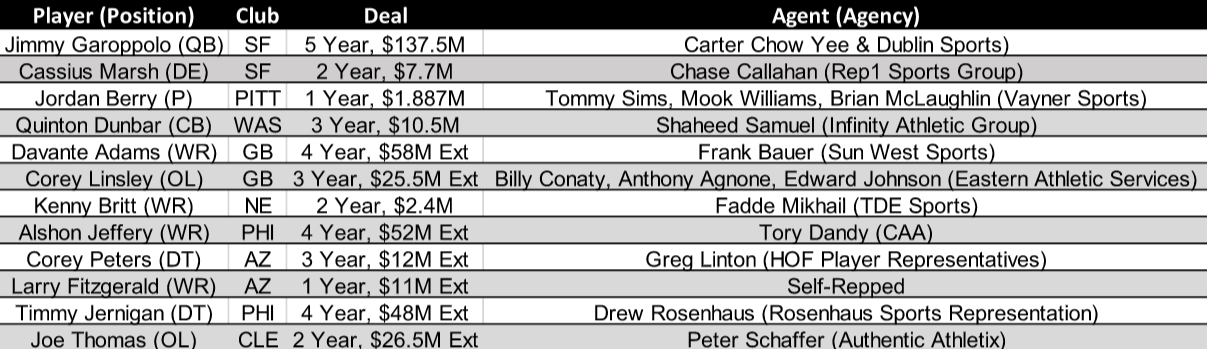

Notable Deals

Below are notable deals from November-February. WRs cashed in as Davante Adams, Alshon Jeffery, and Larry Fitzgerald signed big deals late in 2017. Sun West Sports also made this list for the second time in a row as the agency negotiated Matt Prater’s $11.4M extension in October and recently Davante Adams $58M extension.

Entrants/Exits

Active/Inactive Agent movement continued to stabilize over the last month. 7 agents became active while 1 agent saw his active client count come down to zero.

Entrants

Exits

Fry, Robert Thomas – Gil Scott Sports Management

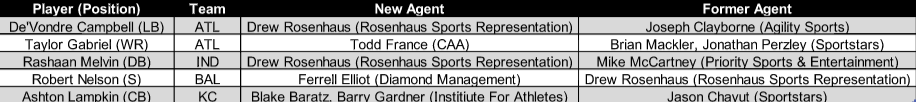

Notable Player-Agent Changes

Rashaan Melvin is the biggest name to make an agent change over the last couple months. Melvin, who Pro Football Focus rated as the 17th best CB this past season, will be entering Free Agency and should earn a deal in the $10M APY range.

Lastly, to cap off this month’s Agent Client Report, below is an updated snapshot of the Agent Industry:

Industry Snapshot (1.26.18)

*Please note Contract Numbers are based off New Money. Any other questions on methodology can be sent to hardiksanghavi29@gmail.com*

- Players Under Contract with Representation: 2421 (includes players on NFI/IR)

- Active Agents: 491

- Active Agencies: 311

Top Ten Agencies by Contracts under Management

- CAA: $3.25B Contracts Under Management; 175 Clients

- Top Agents:

- Todd France: 69 clients (39 co-repped)

- Tom Condon: 49 clients (23 co-repped)

- Jimmy Sexton: 47 clients (32 co-repped)

- Top Agents:

- Athletes First: $1.99B Contracts Under Management; 129 Clients

- Top Agents:

- David Mulugheta: 25 clients (7 co-repped)

- Joe Panos: 22 clients (1 co-repped)

- David Dunn: 21 clients (5 co-repped)

- Andrew Kessler: 21 clients (9 co-repped)

- Top Agents:

- Rosenhaus Sports: $1.11B Contracts Under Management; 105 Clients

- Top Agent:

- Drew Rosenhaus: 104 clients (6 co-repped)

- Top Agent:

- Lagardère Sports: $1.04B Contracts Under Management; 62 Clients

- Top Agents:

- Joel Segal: 54 clients (17 co-repped)

- Chafie Fields: 18 clients (11 co-repped)

- Top Agents:

- Sportstars: $954.60M Contracts Under Management; 134 Clients

- Top Agents:

- Brian Mackler: 47 clients (47 co-repped)

- Jared Fox: 42 clients (37 co-repped)

- Jonathan Perzley: 35 clients (33 co-repped)

- David Butz: 32 clients (8 co-repped)

- Alan Herman: 31 clients (30 co-repped)

- Top Agents:

- Rep 1 Sports Group: $610.92 Contracts Under Management; 62 Clients

- Top Agents:

- Chase Callahan: 24 clients (2 co-repped)

- Ryan Tollner: 24 clients (3 co-repped)

- Top Agents:

- Independent Sports & Entertainment: $567.02M Contracts Under Management; 52 Clients

- Top Agents:

- Doug Hendrickson: 33 clients (15 co-repped)

- C.J. Laboy: 19 clients (15 co-repped)

- Top Agents:

- SportsTrust Advisors: $541.03M Contracts Under Management; 39 Clients

- Top Agents:

- Patrick Dye: 26 clients (4 co-repped)

- William Johnson: 13 clients (3 co-repped)

- Top Agents:

- Select Sports Group: $539.13M Contracts Under Management; 85 Clients

- Top Agents:

- Jeffrey Nalley: 33 clients (15-co-repped)

- Erik Burkhardt: 25 clients (9 co-repped)

- Andy Ross: 16 clients (4 co-repped)

- Top Agents:

- Priority Sports & Entertainment: $344.77M Contracts Under Management; 51 Clients

- Top Agents:

- Mike McCartney: 27 Clients

- Kenny Zuckerman: 14 Clients

- Top Agents:

Previous Reports